If you’re a user of App or considering using this popular mobile payment service, you may be wondering about the official banking partner for...

What is The Cash App Bank Name and Address

If you’re a user of App or considering using this popular mobile payment service, you may be wondering about the official banking partner for...

Online chat platforms like ChatIW can provide a unique opportunity to make meaningful connections with people from all around the world. Whether you’re looking for...

You may use Picuki to discover trending topics, hashtags, and other stuff. You may then utilize it to stay ahead of your competitors. You may monitor the actions of your...

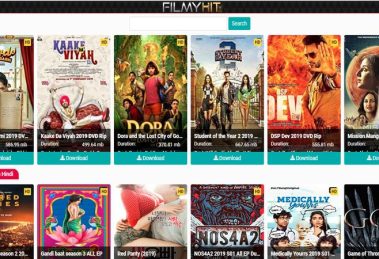

Get ready to explore a world of entertainment with Khatrimaza, the ultimate hub for all your movie download needs. Whether you’re a fan of Bollywood or Hollywood...

We’ll take a wild guess. Since learning about Mangakakalot, you have been looking for a website where you can read manga for free, am I right? In that case...

Manga, an anthology of Japanese comic books and graphic novels, has accumulated an enormous international fan base. Manga has garnered extensive international acclaim on...

Animesuge.to: Is It Safe? A hand-drawn computer animation from Japan is called an anime. The word “anime” is derived from the Japanese word...

Bedpage is a powerful platform that small businesses can utilize to enhance their growth and reach their target audience effectively. Bedpage provides a user-friendly...